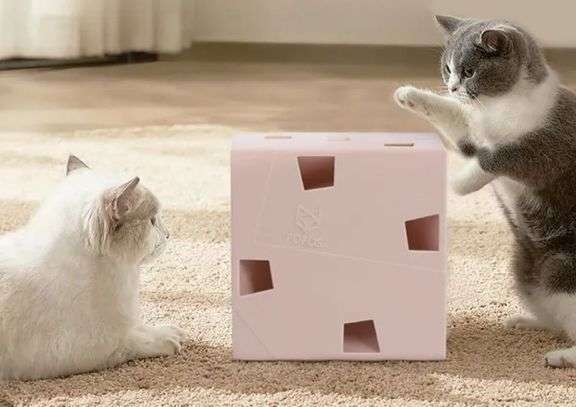

“People want to try toys made for pets even after seeing them.” This user’s comment can very accurately summarize the biggest feature of the pet lifestyle brand “fofos two lucky cats”.

"fofos Two Fofos" (hereinafter referred to as fofos) was hatched in 2017 by Shanghai Baozun Pet, a long-established pet foreign trade company in China. Its core product is pet toys, and its main business scope covers various categories of pet lifestyle. Founded in 1995, Shanghai Baozun Pet not only has more than 27 years of foreign trade history in the pet industry, but also participates in investments in pet and related industries as an investor as an LP, such as the angel of the new pet consumer brand "FurFurLand" round of investment.

Different from other new pet consumer brands, behind the hit products is a mature business system that fofos has quickly built using its own experience and resource advantages. Tina, the co-founder of the company, told Red Bowl News that fofos has formed a "four-legged walking" at the business level: the two major channels of overseas professional pet chains and cross-border e-commerce, and the two major channels of domestic new retail e-commerce and traditional dealers. This system ensures the steady development and ability to withstand fluctuations at the overall level of the fofos company, and also ensures that the team can focus undivided attention on product innovation itself.

Currently, fofos’ 100-yuan smart toy has been sold globally for more than 100,000 units within half a year of its launch, and the brand’s overall monthly sales have reached millions of yuan. Fofos' ROI for Tmall live broadcast from January to December 2021 reached 5.2.

“The pet industry is going through a process from being too hot to gradually returning to rationality.” Tina said that the era of competing for sales is passing, and the brand will eventually return to profitability, and the key factor is Who can truly make good products and brands?

The road of "returning overseas" for established pet companies

After nearly 27 years of development, in 2017, Shanghai Baozun Pet Products Co., Ltd. (hereinafter referred to as "Baozun Pets") began to focus on overseas Transfer to the country.

The emergence of a signal has brought about changes in the company's internal thinking: the domestic pet industry is entering a stage of rapid growth. In the past, the domestic pet consumer market was small. With several mature overseas brands already occupying a certain market, there was not much room for new brands to gain a foothold in the country. Nowadays, the domestic pet consumer market is getting larger and larger, which is a good opportunity to enter the market.

Baozun Pet’s strength is in pet clothing and toys. Tina said that in terms of export volume, Baozun Pets, which exports about 78 million pieces of clothing annually, ranks first in the country. But in the end, the clothing industry did not become the direction that new brands aimed at. The reason is: in the past, Baozun only served overseas markets, and there was a big gap between European and American culture and Asian culture in terms of pet clothing. In the field of domestic pet clothing, there are brands and Taobao collection stores, but the price system in the industry is confusing, and prices have been The price is very low, and the profit margin is not large; clothing products involve multiple sizes and colors, which is relatively risky for the brand.

Based on this, the idea adopted by fofos is to target the domestic traditional channel market and choose a suitable category. "The channel market determines that we cannot choose products with high logistics costs, so we did not consider cat houses and dog houses, and consumers are unlikely to repeatedly purchase pet houses that are not very different. Toys are small in size and not affected by seasons. , the logistics cost is low, you can take the wholesale agent route."

According to Baozun Pet's past research on overseas markets, toys are also a huge market in pet consumption. To be more precise, it should be defined as a consumable rather than a daily necessities. When people buy toys, they will find that they do not buy a specific toy multiple times, but they continue to buy different new styles of toys.

Although the market potential of pet toys has been verified, it does not mean that the business is as simple as it seems. In fact, there are big differences in the concepts and consumption habits of pet owners at home and abroad. The rise path and methodology of mature overseas brands are not suitable for the local market. If domestic brands want to succeed, they need to gain consumer insights and make timely adjustments.

Specifically, foreign pet owners prefer plush toys and buy such products for their pets every week. In their opinion, stuffed toysToys that cater to your pet's most primitive nature - chewing on toys with this plush texture will bring them joy. Therefore, in their logic, a toy that is chewed up quickly can just show that the pet likes it and uses it frequently, realizing the original intention of the toy to bring happiness to pets.

In China, consumers pay more attention to durability. A product that is very easy to bite is likely to be considered as a merchant's product that is not up to standard. Therefore, for the domestic market, durability must be taken into consideration when selecting materials and shapes of pet toys. For example, the "Magic Fitness Ball" launched by fofos - a smart pet toy with lights that can intelligently avoid obstacles and plan escape routes - this kind of toy product with obvious playability and even digital electronics is more popular among consumers than abroad. favored by those.

The secret to popular products is “no secret”?

“Toys are often replaced with new ones. Manufacturing is not the difficulty, but whether the company has the ability to continue development. fofos is not worried about plagiarism. First, some products have already applied for patents. The second is that if you want to plagiarize, you have to keep copying. Our core competitiveness is the integration of design, R&D, supply chain, and hot product marketing, so plagiarism will not pose a threat to us." Tina told Red Bowl Society.

There are two difficulties in developing pet toys.

First of all, people buy pet toys, so the products must be attractive and attractive in appearance. Secondly, the person playing with the toy is a pet, so you need to consider what kind of materials and sounds will attract the pet's attention. Since individual pets vary greatly, a huge cognitive library of pet behavior needs to be established behind product development. It is difficult to make 100% of pets like a certain toy, but you can try to achieve that 80 to 90% of pets will be interested.

fofos has several representative products, one of which is called "Crazy Woman". Before the rise of Xiaohongshu and Douyin, and before fofos entered Tmall, the monthly offline sales of Crazy Woman’s single product exceeded 10,000 pieces. Its ability to achieve good sales results relies solely on word-of-mouth among consumers.

There is no mysterious methodology behind this hit product. Tina said that in the entire product development, fofos has always followed the logic of obtaining inspiration from a wide range of dimensions. FOFOS has an independent intelligent research center, and its team includes designers, pet behavior experts, and pet doctors. They are also pet owners and have rich experience in raising pets. In terms of product development, everyone can initiate brainstorming. Sometimes a children's toy can inspire everyone. With inspiration, professional innovation and research and development can be carried out for pets.

Since 2017, fofos has launched a total of about 500 pet toys. "Fofos adopts a combined approach behind 500 toys. There are traditional plush rubber toys, smart toys and some creative toys. Because when it comes to buying toys, everyone likes the new and dislikes the old, so the same type of productsYou may not necessarily buy it next time, so you need to produce new styles for each type based on the characteristics of the crowd, but the update rhythm is different for different types. For example, smart toys require a long period of polishing, and we may only produce 2-3 classic styles a year; plush products mainly test appearance, so we will speed up the pace of new products while ensuring that the products have bright spots. ”

Tina predicts that the current new product launch pace of fofos will remain at about 100 new products per year. At the supply chain level, fofos is also continuing to make efforts. In 2021, fofos has begun to establish an approximately 100 new products in Nantong. 30,000 square meters of production base. About 10%-15% of the order volume will gradually be converted to its own production and manufacturing.

Tina pointed out that it is easy for good products to be copied by others in the industry. So pets Entrepreneurs in the toy industry need to think clearly about the product life cycle, patent protection and other aspects before starting this business.

An unexpected turn of events

The epidemic has brought awareness to fofos An unexpected turn of events.

According to fofos’ original plan, 2019 is an important year for the company to complete its “two-legged” walking plan. In 2019, fofos began to fully enter the global market, setting up branches in the United States and Belgium. The company cooperates directly with first-tier pet product retailers in Europe and the United States, such as Petsmart, Petco, Kmart Australia, etc. It also cooperates with high-quality agents from various countries and successfully enters the South American, Southeast Asian, Japanese and Korean markets. As a result, at the end of 2019, the new crown epidemic broke out, and The entire plan had an unexpected impact.

But coincidentally, it was also the same year that the fofos team decided to change its thinking on domestic sales channels, from relying entirely on offline agents in the past to online At the end of 2019, fofos officially opened its own Tmall store. Looking back now, perhaps it was precisely because of this opportunity that fofos focused on studying online channels throughout 2020. And successfully completed the "e-commerce" transformation. Today, nearly half of fofos' revenue structure comes from online channels.

"Today we see that fofos has more product lines Some products in other categories, such as cat litter, cat cleaning supplies, etc. These are measures launched based on online logic. If it is purely a toy online, its repurchase frequency is limited. Therefore, on this basis, fofos combined the advantages of its own supply chain - because we have also invested in a cat litter factory - to create high-end products, which have also been recognized by consumers. "Tina said that fofos still insists on reflecting differentiation in other products and launching new products based on the needs of online consumer groups.

Today, fofos is also trying more new sales and promotion channels , for example, they have cooperated with leading anchors in the industry such as Li Jiaqi in the past. In Tina’s view, cooperation with leading live broadcasts on the one hand proves thatofos' products can be recognized by the industry and can withstand testing; on the other hand, fofos has always maintained a prudent attitude towards live broadcasting. Today, many brands are “kidnapped” by capital or pursue GMV performance too much, which is divorced from fofos’s understanding of the healthy and lasting development of the brand. For a brand, the most important thing is to have strong enough profitability.

As for the future direction of competition in the entire industry, Tina believes that we should return to good products and good brands: the pet industry was too hot in the past two years, but now it is returning to rationality. Amidst the turmoil, the industry will also undergo a reshuffle. The ability to make profits will become critical.